School Choice > Iowa

Iowa School Choice Programs

Parents and guardians have plenty of options in Iowa when it comes to School Choice. If open enrollment (including magnet schools and a few charter schools) or homeschooling options aren’t right for your family, consider starting an Educational Savings Account for private schooling instead.

Earn money with each latté, tank of gas, or grocery run. RaiseRight is the easiest fundraising program you can run to benefit your members, families, and communities.

Generate up to 5x more earnings—just by shopping with gift cards. No selling goods, planning events, or knocking on doors.

How to offset private school tuition costs in Iowa

Searching for ways to fund your child’s private school education? Iowa offers different publicly funded School Choice programs that you can apply for.

Option #1

Education Savings Account (ESA) Program

Participants in Iowa’s ESA program gain access to approximately $7,413 of public education funds per child in a private school each year. Funds in an ESA can be used to cover much more than just tuition, making it a flexible, effective option for Iowa families.

Option #2

Tax Credits/Deductions

Offset additional educational costs (like uniforms, standardized test fees, and textbooks) with over $200 dollars worth of tax rebates and deductions from the state of Iowa.

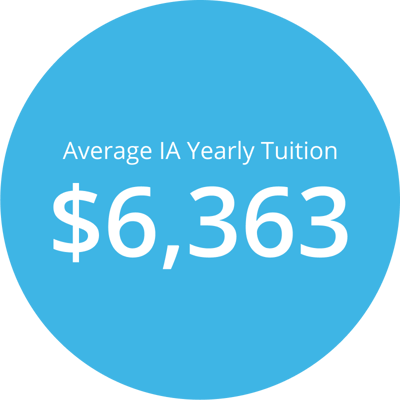

Comparing all Iowa School Choice offerings

| Program Name | Type | Average Award | Eligible Expenses | Average Yearly Tuition |

|---|---|---|---|---|

| Education Savings Account Program | Education Savings Account (ESA) | $7,413 | Tuition, tutoring, credential, therapies, online learning, etc. | $6,363 |

| School Tuition Organization Tax Credit | Tax-Credit Scholarship | $1,465 | Tuition | $6,363 |

| Tuition and Textbook Tax Credit | Tax Credit/Deduction | $210 | Educational expenses, including tuition, textbooks, activity fees and lab fees | $6,363 |

Education Savings Account (ESA) Program

If you’re interested in setting up an Education Savings Account to fund your child’s private school education, you’re probably searching for relevant details about the program. This mini-guide will help families successfully navigate Iowa’s ESA program.

To qualify, students must

- Have a child who is switching to a private school from a public school or a child who is entering kindergarten.

Students who are already attending a private school may also apply, but they must come from families with an annual income of less than 400% of the Federal Poverty Level. - Provide proof of enrollment in other income-based assistance programs, like SNAP or childcare assistance (for existing Iowa residents)

- Provide the most recent out-of-state tax return or a recent pay stub from each parent/guardian and letter from each parent/guardian’s employer confirming their annual income (for new Iowa residents)

Families must submit a single application on a yearly basis—this application covers all school-aged children in the household. If you choose to submit your family’s application through the online automatic verification system, your account may be approved in as little as 30 minutes. You can find detailed ESA application information and relevant links on the Iowa State Government’s website.

One of the central benefits of an ESA program (in comparison to a voucher program, for instance) is that the allocated funds in the account can be dedicated to tuition and other education-related expenses. This means that you can use public funds to pay for things like books, software, course materials, sensory items, educational services, therapies, and life skills education.

Flexible, easy to access, and convenient, Iowa’s Educational Savings Account Program might just be a perfect fit for your family.

Iowa Tax Credits/Deductions

Iowa citizens can receive up to $500 per dependent if they spend $2,000 in educational expenses like tuition and textbooks. You can learn more about the School Tuition Organization Tax Credit here or learn more about the Tuition and Textbook Tax Credit here.

The average Tuition and Textbook Tax Credit award is $210, so if your educational costs exceed that, consider setting up a RaiseRight program to help families further their expenses. Learn more here.

Save more on your child’s education with RaiseRight

Families earning with RaiseRight know it’s the easiest, most effective way to offset private school costs. While Iowa's benefits can help, they don't completely cover the full scope of fees. By maximizing your RaiseRight earnings, you could save over $1,000 a year to offset school costs and reduce financial strain.

*Based on average spend for a household family of 4